Citigroup sees Ethereum at $6,400

Citigroup projects that the price of ether (ETH), Ethereum’s cryptocurrency, could reach $6,400 by the end of 2025 in a bullish scenario.

The financial institution highlights that the growing activity on Ethereum and the adoption of applications based on this network, such as stablecoins and asset tokenization, drive this projection.

However, in a bearish case, marked by a rebound from the macroeconomic crisis and declines in stock markets, the price could fall to $2,200, Citi said in a note reported by Reuters.

In addition, Citigroup sets a price target of $4,300 by the end of the year, based on investor demand and interest in Ethereum use cases. This target, however, is below the all-time high reached by the cryptocurrency last month, as reported by CriptoNoticias.

The bank notes that the recent surge in ether’s price could be influenced more by market enthusiasm than solid fundamentals, as current prices beat estimates based on network activity.

On the other hand, activity on the Ethereum network remains the main driver of ether’s value, although much of the recent growth has been concentrated in layer-2 solutions. Citi warns that the shift of value from these secondary layers to the Ethereum base layer is unclear, which could limit its impact on the price.

In turn, staking, a mechanism that allows ether holders to earn additional yields by locking up their cryptocurrencies to support network operations, has cemented ETH as an attractive asset for companies looking for active profitability. Especially in companies that have established corporate treasuries based on cryptocurrency.

As for exchange-traded funds (ETFs), Citi notes that their capital flows are lower than bitcoin (BTC) funds, a pattern observed since their launch in July 2024. However, Ethereum ETFs have shown significant improvement since April. For example, yesterday they registered net inflows of 360 million dollars, marking five consecutive days of positive flows.

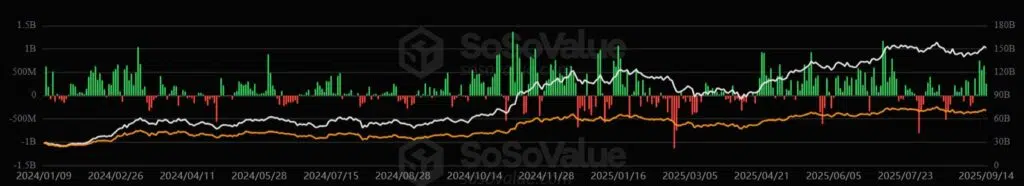

The chart below, provided by SosoValue, shows how capital has flowed to and from ether ETFs since their launch:

Currently, these funds accumulate net assets of 151,000 million dollars. The demand for ETFs directly impacts the price of ETH, as managers must acquire the cryptocurrency to back their shares, raising its price due to the dynamics of supply and demand.

Nonetheless, Citi anticipates that the impact of ETFs on the price of ether will remain limited due to the cryptocurrency’s lower market capitalization and lower visibility among new investors compared to bitcoin.