SharpLink raises $200 million to buy more Ethereum

SharpLink Gaming, Inc., a betting company listed on the Nasdaq, raised $200 million through a direct offering led by four global institutional investors, priced at $19.50 per share.

The company will allocate these funds to increase its Ethereum Treasury (ETH), Ethereum’s cryptocurrency, to exceed $2 billion in the coming days, according to the US company.

With this operation, SharpLink reinforces its strategy of accumulating ETH and using swinging mechanisms to generate returns, aligning itself with its long-term vision.

The company stressed that its mission is clear: to position itself as a key player in the ecosystem of Ethereum, which they consider the basis of global finance. Ethereum is becoming the fundamental layer of global finance, and SharpLink is designed to capture that potential, the company said.

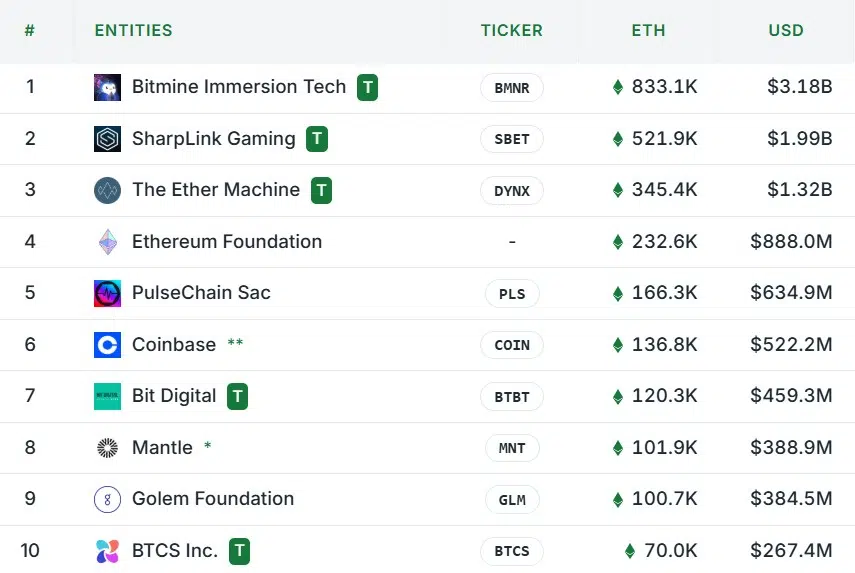

Currently, SharpLink owns 521,900 ETH, making it the second largest public listing company in this cryptocurrency, only behind BitMine Immersion Technologies, which leads with 833,100 ETH.

As CryptoNews reported, ETH’s holdings in the treasuries of 67 entities, including public companies, DAOs, foundations, and governments, reached a record 3 million ETH, equivalent to $11.6 billion. This volume reflects an increase of 2,500% since April, when corporate reserves totaled just 112,960 ETH.

In addition, SharpLink is not only dedicated to accumulating ETH, but also actively promotes Ethereum. In recent months, the company has used its social networks to highlight the advantages of this network and its potential to transform the traditional financial system, positioning itself as an advocate of decentralization and digital finance.