Bitcoin & Ethereum before mega expiration: Billions move on Friday

On Friday, one of the biggest options schedules of all time is on the agenda. On the trading platform Deribit, Bitcoin (BTC) and Ethereum (ETH) options worth 14.6 billion dollars are running out. The question is whether this event sets the tone for the market in September.

Billions of options expire

According to figures from, there are 56,452 call options and 48,961 put options on Bitcoin, which together represent an open interest of 11.62 billion dollars. At Ethereum, the total amount is 3.03 billion dollars. Especially striking is that there is a huge demand for put options around 110,000 around the current Bitcoin price. The most popular call options, on the other hand, are higher, starting at 120,000 dollars.

Call options give the right to buy a coin at a pre-determined price, while put options give the right to sell. Open interest refers to the total number of contracts that have not yet been settled and shows where traders have built up their positions. It is therefore an important indicator of market expectations.

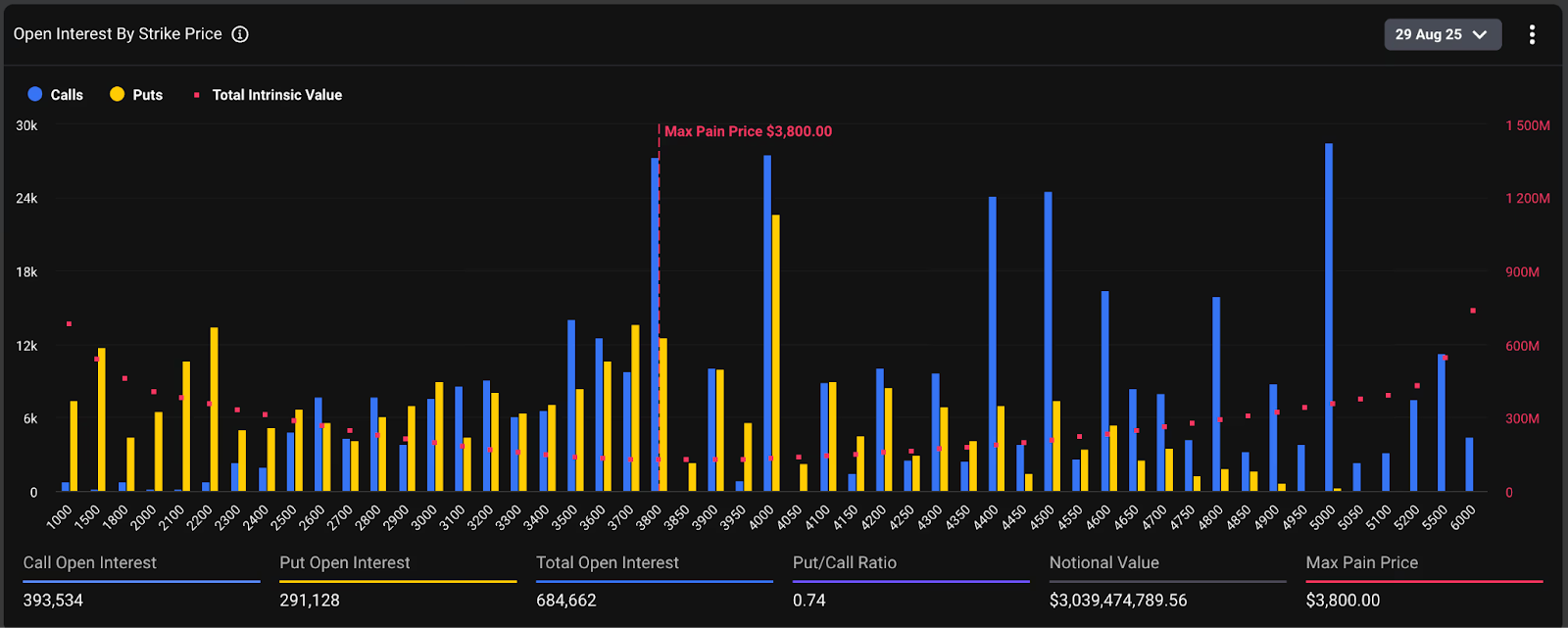

Ethereum options show a more balanced distribution.

At Ethereu, the image is more balanced. There are 393,534 call options compared to 291.128 put options. The most important levels of calls are 3,800, 4,000, and 5,000 dollars. For puts, they are 4,000, 3,700, and 2,200 dollars.

Traders also pay attention to the so-called ‘Max Pain’ level, the price at which most option holders would suffer losses. Currently, it is 116,000 dollars for Bitcoin and 3,800 dollars for Ethereum. Whether the market actually moves there remains an object of discussion.

Expiry can set the market in motion

According to Deribit, the interest in hedging against losses in the price of Bitcoin remains unabated. At ETH, the distribution between calls and puts seems to be more balanced. If this is put beside the recent statements made by Jerome Powell in Jackson Hole, the combination could be crucial for market sentiment in September.

What this Expiry may mean further is that the market is temporarily becoming additionally volatile. Great sequence moments often lead to fluctuations at important price limits, especially when traders try to steer the prices towards the Max Pain point. At the same time, the demand for Bitcoin puts can be seen as a sign of caution, while the more balanced distribution at Ethereum is more likely to point to more neutral sentiment.