SharpLink in trouble, possible bottom for Ethereum?

The American investment company SharpLink is under pressure. The company, which is considered the Ethereum equivalent of strategy, is less valuable than its own crypto reserves. The market value has fallen below the level of its Ethereum possession – a rare and remarkable situation.

SharpLink is worth less than the Ethereum it owns

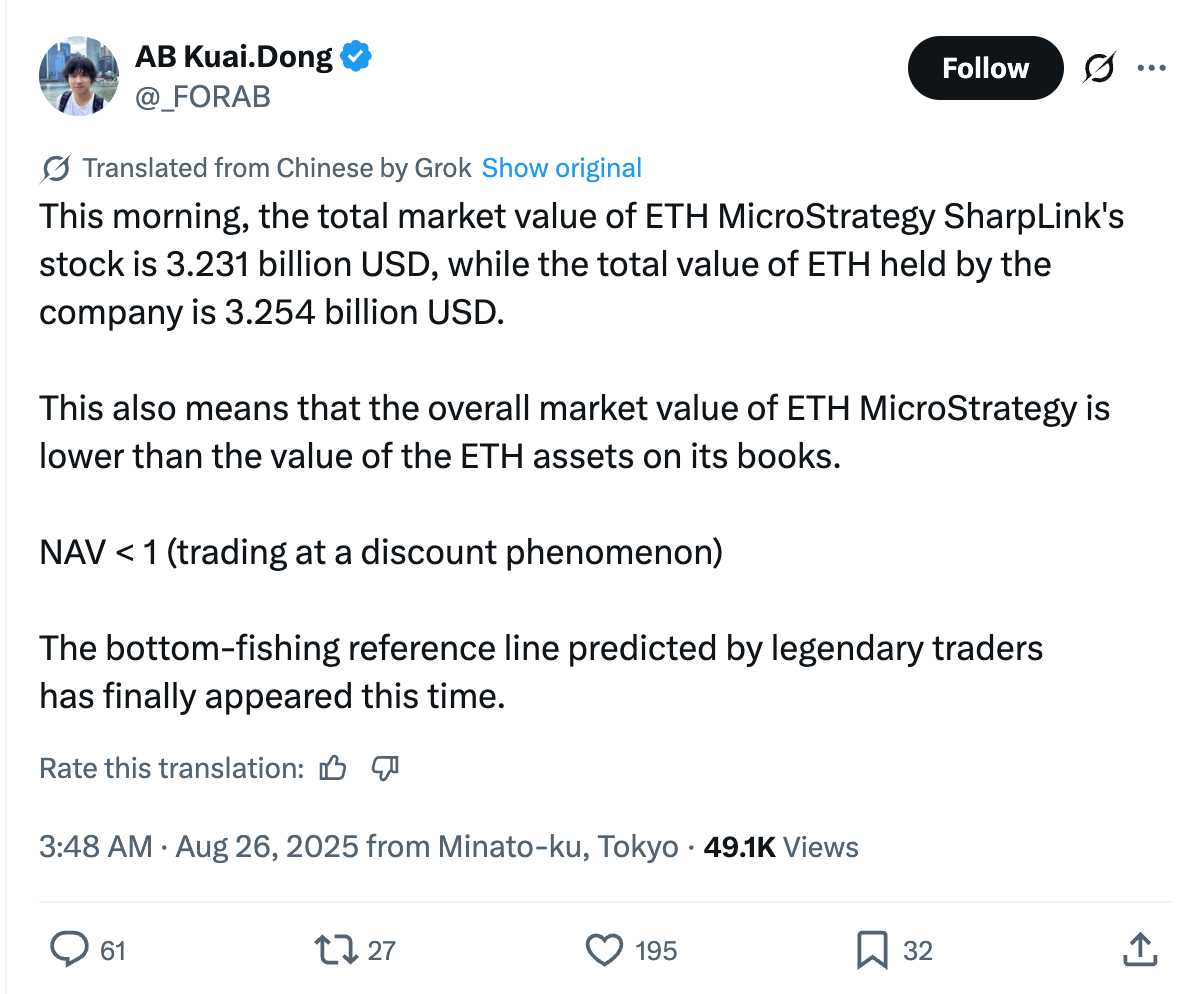

According to the latest figures, Ethereum, SharpLink are worth 3.29 billion dollars, while the company’s total stock market valuation is about 3.24 billion dollars. This means that investors value the company less than the cryptocurrency it has in its cash.

According to analysts, such a situation is rare. Normally, listed companies trade in cryptocurrency in the cashier for a premium because investors include future returns or additional capital flows. “If the market value is lower than the value of ownership, many traders see it as a contrary signal,” says market observer Kuai Dong.

At the same time, SharpLink announced a large USD 1.5 billion share buyback program last week. This means that the company wants to buy back almost half of the current market value, an unusually big step that temporarily drove Ethereum prices.

NEW: SharpLink’s board of directors authorizes $1.5B stock buyback programhttps://t.co/ANtveVdIMD

— SharpLink (SBET) (@SharpLinkGaming) August 22, 2025

Bottom in sight for Ethereum?

The question is whether this indicates everything to a ground for Ethereum. The coin itself fell by about five percent yesterday and was noted at around 4,415 dollars. Economist Donald Dean expects high price targets for SharpLink in his models when Ethereum rises again. At an Ethereum price of 5,000 dollars, the stock could rise to more than 40 dollars, more than double the current level.

$SBET SharpLink Gaming – NAV is equal to 1, Good Risk / Reward

Price Target: $37.22, $40.37, $48.28

Breakout and consolidation at the volume shelf launch area. SBET NAV is = 1.00, calculating no premium. Risk / reward is good here.

Price target are at 1.8x NAV:

ETH $4600 =… pic.twitter.com/uNx5BxOgYZ— Donald Dean (@donaldjdean) August 25, 2025

However, there is also criticism. The crypto commentator Grubles points out that the staking of Ethereum brings in less than US government bonds. In his opinion, SharpLink provides shareholders with fewer returns than would be possible.

For many investors, however, it is less about the details of the business model, but more about the broader signal. The fact that a stock exchange fund acts below the value of its crypto ownership is seen as a moment of capitulation in the market. For some, this is just the point where a new uptrend could begin.