XRP is changing hands Who buys and who sells?

The big investors of XRP, the cryptocurrency of the company Ripple Labs, have changed their behavior remarkably since early July.

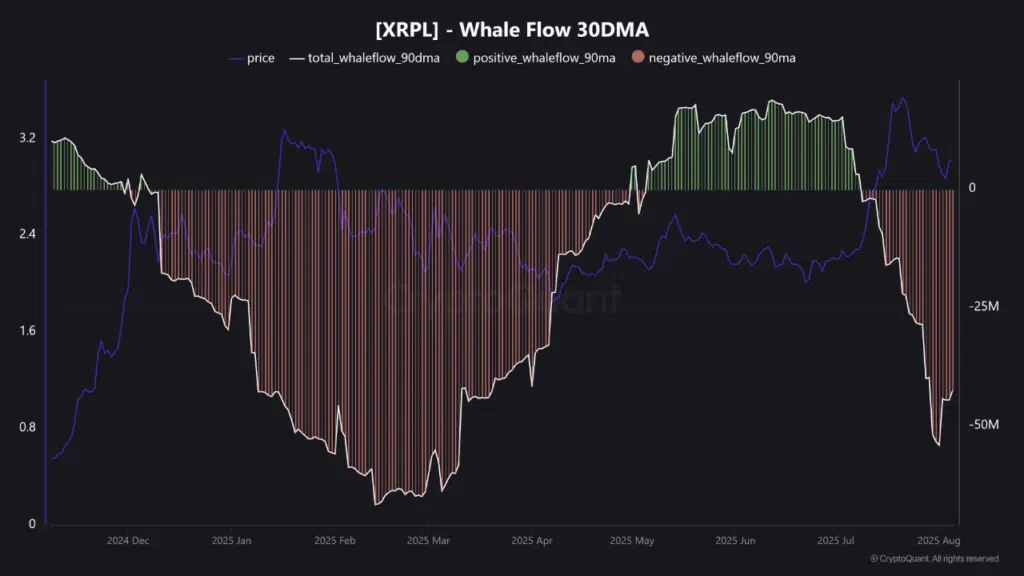

On-chain data reflect that the accumulation flows of whales (directions that possess at least one million units of XRP) were abruptly reversed and now record net outflows.

In this regard, a market analyst from the community of CryptoQuant explains that a similar pattern occurred between January and February, when a local maximum in price coincided with a sustained distribution by the whales and a subsequent correction.

The graph of CryptoQuant, a firm specializing in on-chain analysis, shows the entrances (green bars) and exits (red bars) of funds from the large portfolios.

During red-bar peaks, there is a subsequent drop in the price of XRP (blue line), suggesting that whale sales often anticipate corrective movements in the price.

The analyst also adds: “While the current fall is shorter in duration and less profound, the directional alignment is significant. Unless we see sustained positive flows from whales (more than 5 million XRP per day), the market could remain structurally weak. At the moment, there are no signs of constant accumulation on the part of the big holders, a key component for a reversal of the constructive trend.

However, it should be noted that, although this distribution pattern suggests a structural weakness, it is not translating into a deep correction in the price of XRP, which is currently trading above $3, 16 percent below its historic peak of $3.65.

The fact that there is a price drop could be explained by a change of hands: it is possible that those XRPs are being absorbed by corporate treasuries.

Recent movements that reinforce this hypothesis include that of Webus International, a Chinese-based company listed on the Nasdaq, which invested up to $300 million to build an XRP treasury, as reported by CryptoNews. The company’s goal is to develop an infrastructure for future operations with XRP and other cryptocurrencies.

For its part, VivoPower, another company listed on the Nasdaq, placed $121 million to add XRP to its corporate treasury. The same steps were taken by Worksport, a truck deck manufacturing company, which made an investment of $5 million in the Ripple and bitcoin cryptocurrency (BTC).

Amber International also announced the formation of a $100 million strategic reserve, consisting of a basket of digital assets, including XRP, BTC, Solana (SOL), BNB, SUI (SUI), and ether, the native currency of Ethereum.

The institutional capital entry not only reinforces XRP’s narrative as a reserve asset but also increases its visibility among more traditional investors, boosting liquidity in the Ripple ecosystem.

While individual whales (old investors in XRP) are detaching from their XRPs, big institutional investors seem to be taking their place.