Worldcoin becomes a Nasdaq-listed company

Eightco Holdings Inc. (OCTO), a Nasdaq-listed company, announced today, Sept. 8, that it plans to raise $270 million to fund the formation of a strategic reserve of worldcoin (WLD), the native token of World, the firm powered by OpenAI CEO Sam Altman.

To this end, the company specializing in financing solutions for e-commerce and custom packaging reported a private placement for approximately $250 million, selling around 171 million shares at $1.46 each.

BitMine — Tom Lee’s company that owns the largest amount of ether (ETH), Ethereum’s native cryptocurrency, on its corporate balance sheets — was also reported to be buying a total of $20 million worth of shares.

In addition, the company announced that, once the offering concludes, it intends to change the stock ticker from OCTO to ORBS, in reference to the “orbs”, the biometric devices that World uses to verify the identity of users.

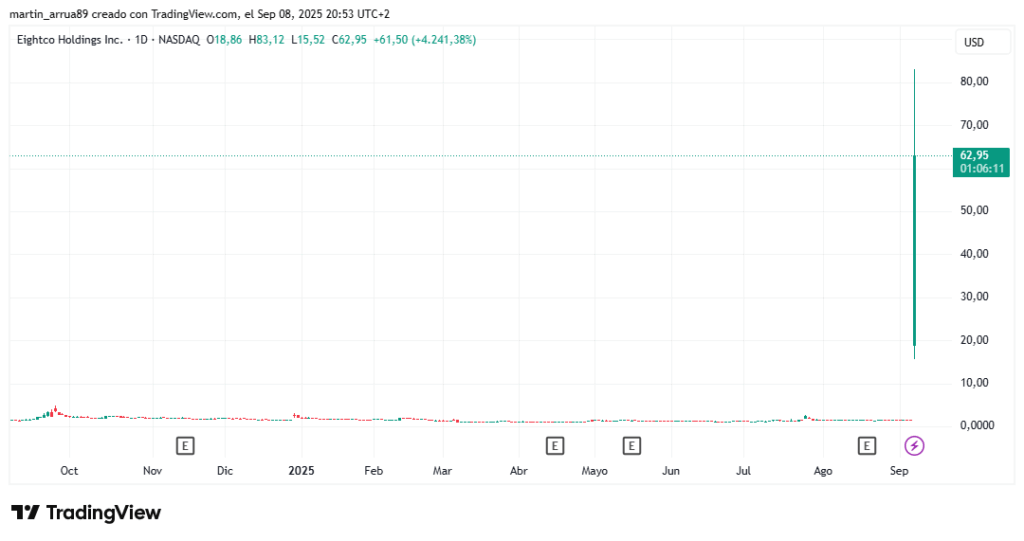

It should be noted that it will be the first company to incorporate Worldcoin as a reserve asset. Following the announcement, OCTO’s price increased by more than 50 times in just one day, as seen in the following chart from TradingView:

Dan Ives, the new CEO of OCTO’s Board of Directors, said: “The future of AI requires the World to lead the way in this fourth AI-driven Industrial Revolution. The world is the internet of people. While AI gives us infinite abundance, the World gives us infinite trust and authentication.”

After the news broke, WLD’s price went from $1.04 to $1.44, representing a weekly rise of 38%.

As reported by CriptoNoticias, more and more companies are analyzing the possibility of incorporating digital assets into their treasuries as a reserve asset. This is a trend that was started by Michael Saylor, CEO of Strategy, in August 2020, when he made the first purchases of bitcoin (BTC).

Since then, Saylor devised a strategy to obtain liquidity quickly through the issuance of debt and convertible securities, which allowed him to finance the purchase of BTC without relying on the company’s operating income.