Treasury B.V. Announces Plans to Create the Largest Corporate Bitcoin Treasury in Europe

Treasury B.V., a Netherlands-based firm, announced on Wednesday that it raised EUR €126 million ($147 million) in a private round of funding. The deal was led by Winklevoss Capital and Nakamoto, a subsidiary of KindlyMD led by David Bailey.

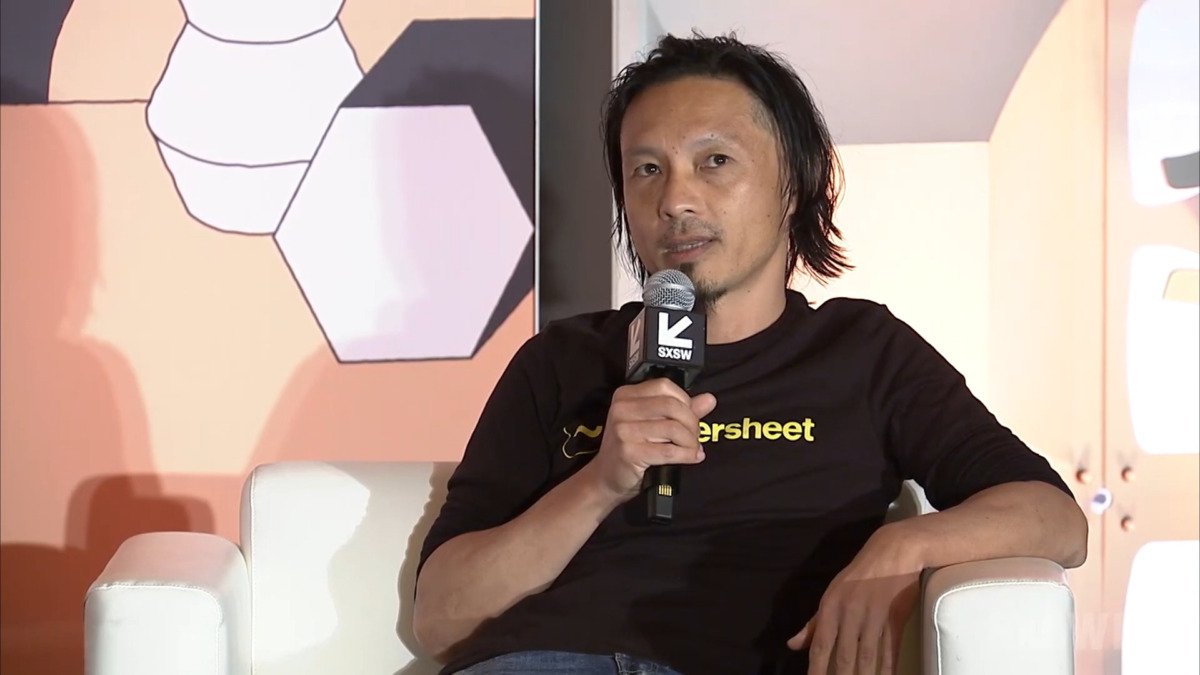

The company, headed by CEO Khing Oei, is looking to consolidate itself as the largest corporate Bitcoin treasury in Europe. Its model is inspired by the practices of U.S. companies that have adopted BTC as a reserve asset, a move that has already impacted the corporate balance sheets of several publicly traded companies.

According to a statement reviewed by The Block, Treasury B.V. has already accumulated more than $111 million worth of Bitcoin at current prices, funded with a combination of equity and debt. The goal is to “systematically accumulate” BTC as its main reserve asset and develop yield strategies based on this cryptocurrency.

Expansion strategy and IPO

The company plans to list its shares on Euronext Amsterdam through a reverse merger with MKB Nedsense N.V. As part of its visibility and positioning strategy, it will also take over the direction of the Bitcoin Amsterdam conference, one of the most influential events in the European ecosystem.

To bolster its structure, Treasury B.V. will form a strategic advisory board that will include twins Cameron and Tyler Winklevoss, as well as David Bailey, publisher of Bitcoin Magazine. This network of allies seeks to give greater credibility to the project in the competitive European financial environment.

The funds raised in the round have already been used to acquire more than 1,000 BTC, strengthening its balance before the debut on the exchange. Additional investors who participated include UTXO Management, Off The Chain Capital, and M1 Capital, among others.

Khing Oei’s vision and the idea of making Bitcoin “more equitable”

CEO Khing Oei stated that “BTC is shaping the future of global financial markets, and the next wave, which we call the equitization of Bitcoin, will dramatically expand access and ownership at levels that will rival traditional markets.”

The company expects to trade under the ticker “TRSR” once the reverse merger process with MKB Nedsense is completed. This step represents an ambitious move in the consolidation of an American-style “Bitcoin Treasury” model, now adapted to the European context.

Bitcoin treasuries between companies around the world

The Treasury B.V. adds to a growing trend among corporations to accumulate BTC as part of their financial strategy. According to market data, corporate treasuries already manage more than 4% of Bitcoin’s total supply, equivalent to about 780,980 BTC valued at more than $87 billion.

The undisputed leader in this space is Strategy, a company led by Michael Saylor, which recently expanded its position with the purchase of an additional 4,048 BTC for $449.3 million. Currently, the company holds more than 636,505 BTC.

On the other hand, KindlyMD has also entered this dynamic after merging with Nakamoto Holdings. In August, the firm acquired 5,744 BTC for approximately $679 million, consolidating itself as one of the most aggressive players in building corporate reserves in Bitcoin.

The case of Treasury B.V. reflects how Europe is beginning to catch up with the wave of corporate bitcoin accumulation that is already trending in the United States and Asia, showing that the competition to lead the infrastructure of this new asset class is rapidly globalizing.