Bitcoin suffers largest whale sell-off since 2022

Bitcoin (BTC) whales, those wallets with more than 1,000 coins accumulated, reduced their reserves as a whole. They sold over 100,000 BTC over the past 30 days, being the largest massive outflow of bitcoin by these large investors in 3 years. A situation that is also exerting direct downward pressure on the price of the digital currency.

This trend reflects a growing risk aversion among large bitcoin holders. As market analyst Cauê Oliveira sees it, this situation “has been penalizing the short-term price structure,” pushing it below $108,000.

“Right now, we are still seeing these reductions in the portfolios of major players, which could continue to put pressure on bitcoin in the coming weeks,” Oliveira noted.

Meanwhile, CryptoQuant’s certified specialist IT Tech commented that following the sell-offs, the whales’ total balance fell below 3.36 million BTC. He also warned that the behavior of these investors “turned deeply negative” after a month.

“The price reaction aligns with the distribution pressure. When whales reduce exposure, it often indicates rotation or preparation for volatility,” he said.

Javier Espasa Peribañez, a master in cryptocurrencies and decentralized finance, told CriptoNoticias that the whales’ movement is nothing more than “the expected transfer of positions” from bitcoin to ether (ETH).

The specialist recalls that in the market “there are many whales with capital gains generated in BTC” and that expectations point to a “revaluation that will occur in BTC and other digital assets.”

“These are the phases that have occurred in previous bull markets,” he notes, projecting that bitcoin will reach $180,000 by the end of this year.

“The global economic situation is generating levels of liquidity even higher than the liquidity generated by the COVID-19 pandemic,” says Espasa. “This very high liquidity is going to go to the cryptocurrency market in a high percentage, and therefore, bitcoin is going to rise strongly,” he adds.

The analyst also rules out that the selling movement by whales will hurt BTC’s price, even in the short term. This is because institutional money makes up for these downward movements of whales, in his opinion.

“ETFs have brought in many billions, and the type of money in the market has varied greatly. In my opinion,n in a positive way,” he says.

A strategic rearrangement

Espasa’s view coincides with that of Doris Yau, an analyst of the bitcoin and cryptocurrency market. For her, as she commented in dialogue with this news portal, the recent movement of BTC whales is, in essence, a “strategic rearrangement” and not a panicky action in the market.

Yau says that 3 key points support this idea. The first is the rotation of capital from the Bitcoin network to the Ethereum network. He recalled that a whale sold $4 billion worth of BTC to buy ETH and that, in August, ETH ETFs captured $3.95 billion, while bitcoin ETFs recorded $751 million in losses.

Another factor is that decentralization is, in healthy terms, as the supply of whales is at a 7-year low. “This strengthens Bitcoin’s decentralization, distributing holdings to smaller holders,” the specialist explained to this media.

A final key point identified by Yau is that, while whales sell, “long-term holders add BTC,” thus recalling the 16,000 BTC recently acquired by these investors.

In short, for Yau, this is nothing more than a “phase of retreat” towards a more mature market. “The sale of bitcoin by whales is sometimes necessary for the next push,” he reflected.

Pushing Down

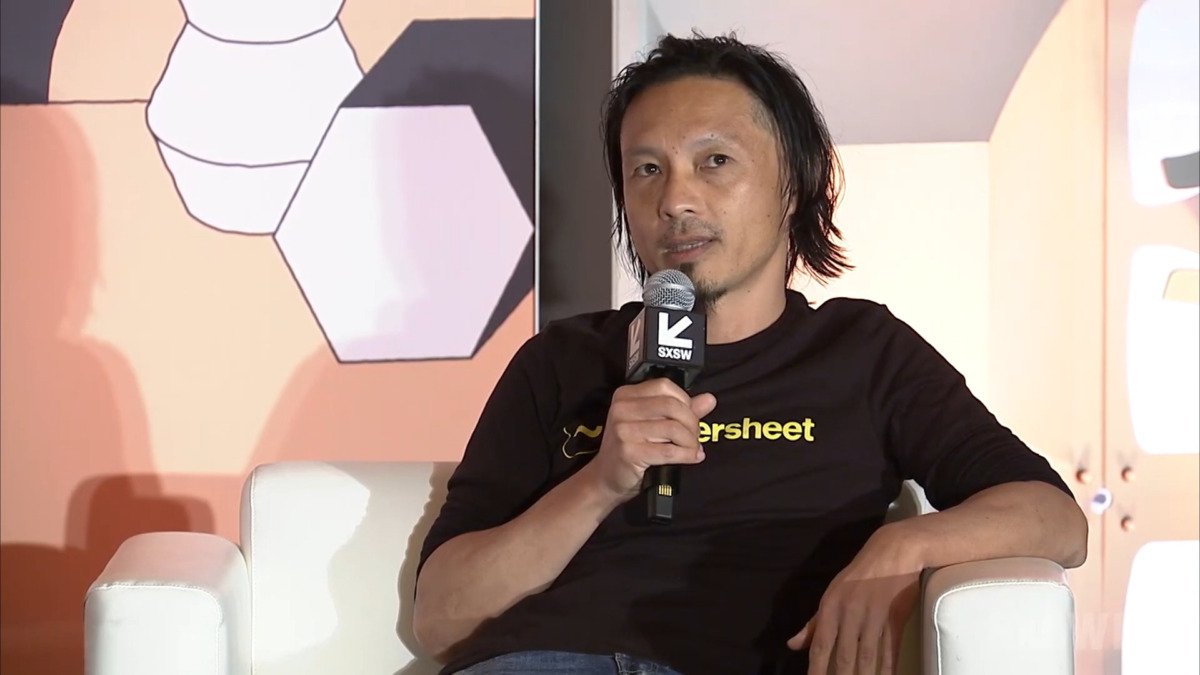

Professional trader Willy Woo brings another perspective on the brake on the market. The specialist says that bitcoin is advancing more slowly than in previous cycles, with rises followed by stagnation or corrections.

“Investors are wondering why Bitcoin is failing to take off strongly. The answer lies in a select group of investors who are holding back the market,” he explained. According to Woo, so-called OG whales, pioneers that acquired large volumes of BTC at prices below $10, are taking profits.

“Each bitcoin that these whales sell requires an income of more than $110,000 of new capital to absorb it and avoid a price drop,” he said.

In this scenario, there have been occasional large-scale movements. On July 26, Galaxy Digital announced the sale of more than 80,000 BTC, valued at $9 billion, in the name of a whale active since the Satoshi Nakamoto era.

The company stressed that this operation was one of the most significant exits in the history of the digital asset market.

A few days earlier, on July 15, another whale that had lain dormant for 14 years transferred 40,000 BTC, acquired for 79 cents, to addresses linked to Galaxy Digital. At the current value, those funds are equivalent to about $4.7 billion. Analysts at Arkham Intelligence identified the transfer, interpreted as a partial sale, taking advantage of the fact that, at the time, the price of BTC was above $120,000.

These examples reflect that old investors are taking profits after years of accumulation. The immediate effect is a selling pressure that exceeds the capacity to absorb new supply.

Still, the trend does not necessarily anticipate a bearish cycle. This is because, while there are whales selling, others also continue to buy. A key example is Strategy, the company of bitcoiner Michael Saylor, which so far manages 638,460 bitcoins, being the publicly traded company with the largest BTC reserves in the world. That entity has bought 31,446 bitcoin since the beginning of July, reinforcing its presence as one of the great “humpback whales” of the market.

Certainly, historical selling by these holders marks a change in the currency’s distribution and pushes it into bearish territory. However, the entry of new institutional players and persistent demand from large investors are key factors that could sustain BTC’s value going forward, according to analysts.