American Bitcoin shares plunge nearly 20% after stellar debut on Nasdaq

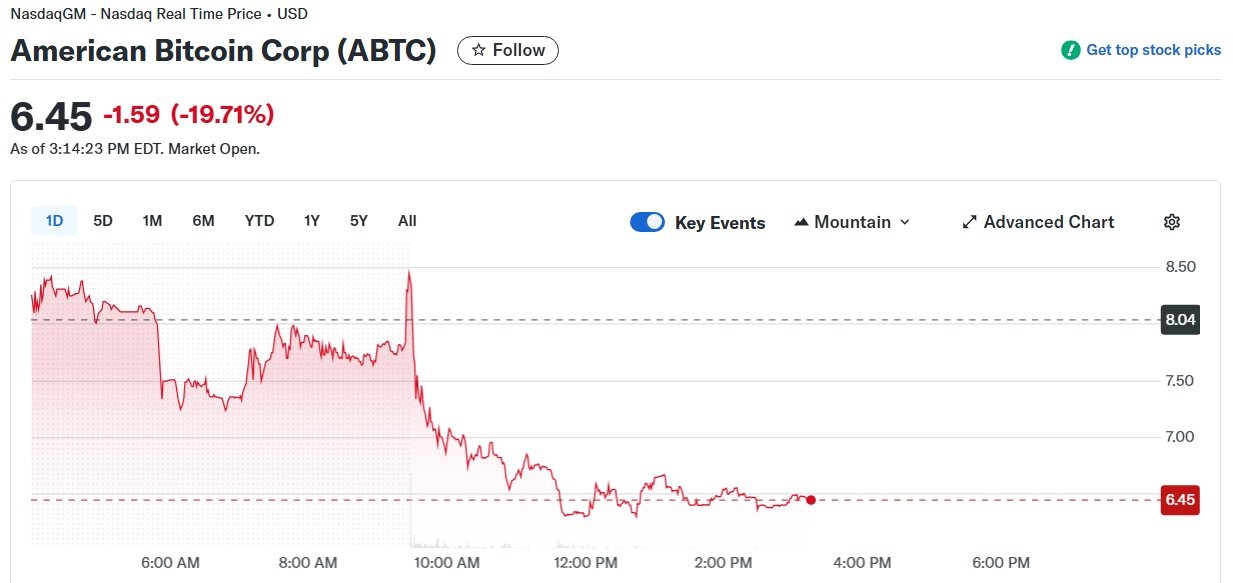

Shares of American Bitcoin, the Bitcoin mining firm backed by the Trump family, fell nearly 20% on Thursday, sitting below its initial public offering (IPO) price of $6.90.

On Wednesday, in its debut on Nasdaq, shares under American Bitcoin’s ticker “ABTC” soared to a high of $14.65, doubling their initial value and bringing the estimated 20% stake valuation of Eric Trump and Donald Trump Jr. — sons of the U.S. president — momentarily to $2.6 billion.

However, at the close of its first day on the stock market, the stock stabilized at $8, giving Donald Trump’s children a valuation of $1.5 billion, as reported by Reuters.

At a current price of $6.45, according to Yahoo Finance data at press time, the stock has retreated 55.8% from its peak reached on its first day on Nasdaq.

American Bitcoin isn’t the only one in a tailspin

American Bitcoin, founded in early 2025, plans to mine Bitcoin using equipment in New York, Alberta, and Texas, powered by Hut 8 Corp., which owns 80% of the company. In addition, the company is betting on a strategy of accumulating bitcoins for its treasury, currently holding 2,443 BTC, valued at approximately $269 million.

On Wednesday, in the midst of its public debut, the company announced a $2.1 billion share sale aimed at acquiring more bitcoin and mining machinery to bolster this strategy.

The drop in American Bitcoin shares coincides with a broader correction in the crypto market, where Bitcoin (BTC) is currently retreating 1.6% over the past 24 hours, trading near $110,000, according to data from CoinGecko.

Other companies with crypto-focused treasury strategies, such as MARA, Strateg, and Bitmine — with the largest Ethereum treasury — have also seen declines of 4.6%, 1.22% and 6.7%, respectively, in their shares during the day.

Meanwhile, World Liberty Financial’s WLFI token, another Trump-backed project, plunged 12.9% on Thursday, after peaking at $0.3313 earlier in the week. The token was listed on major centralized exchanges on Monday, sending its price skyrocketing on the charts; however, it has since fallen by 44%.

American Bitcoin’s decline could be influenced by reports that Nasdaq plans to increase oversight of companies that raise funds to accumulate cryptocurrencies, in a context where 154 U.S. companies have announced plans to raise $98.4 billion for this purpose from January 2025, according to the Financial Times.

Despite criticism over potential conflicts of interest, Eric Trump, chief strategy officer at American Bitcoin, has defended the project, highlighting its role in strengthening the U.S. crypto infrastructure and dismissing the allegations. The Trump family continues to capitalize on the crypto boom, with estimated profits of $5 billion following WLFI’s debut.