The purchase of candle by companies is triggered

The trend of companies that adopt cryptocurrencies as treasury assets is growing, with several protagonists, such as solana (SOL), giving what to talk about.

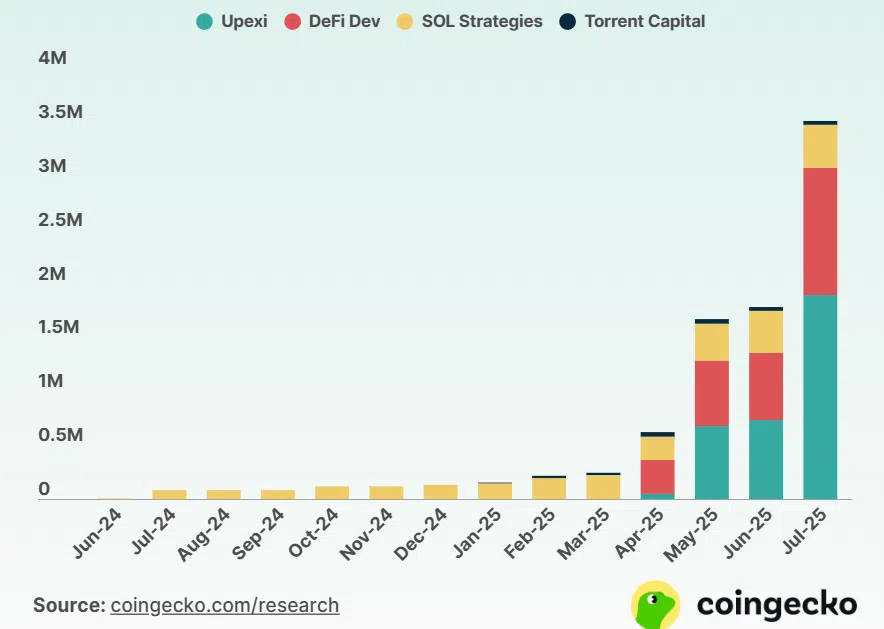

So far, more than 3.5 million SOL is currently in the hands of listed companies. These firms keep it as part of their treasury reserves.

Upexi, DeFi Developments Corp, SOL Strategies and Torrent Capital account for most of this volume. Overall, they control valued positions of more than $591.1 million, representing 0.65% of SOL’s circulating supply of SOL, which is 539.13 million solana.

The following chart shows how solan accumulation has grown between 24 June and July 24 of this year:

Upexi, Inc. leads the list. Over a four-month period, it accumulated $1.9 million from an average price of $168.63. Its initial investment, valued at $320.4 million, is now at $319.5 million, an unrealized loss of $0.9 million. The entire position is in sketch and generated an 8 per cent yield at the end of the second quarter of 2025, according to CoinGecko data.

DeFi Developments Corp is the second largest company. Its treasury includes 1.18 million SOL, acquired in several stages, including a recent purchase of 181,303 coins on July 29 for $28.2 million. The average acquisition cost has been $137.07. As of August 6, its position is worth $198.9 million, an unrealized profit of about $36.8 million.

SOL has followed a strategy of progressive accumulation. Between June 2024 and July 2025 it acquired 392,667 SOL through regular purchases and rewards obtained by sars. Its average cost was $158.12, with a current valuation of $66 million. The unrealized profit amounts to 3.9 million. Unlike Upexi and DeFi Dev., which opted for big purchases, SOL Strategies maintained a regular ticket policy.

Torrent Capital, with a significantly lower position, completed five acquisitions between January and April 2025, adding 40,039 coins. The average price was $161.84. The position is valued at $6.7 million, representing a modest gain of $0.2 million. Although its exposure is lower, the firm bought before SOL’s rebound, allowing it to get a positive performance.

Several of these companies have financed their acquisitions through corporate debt issuance, indicating an active investment strategy with long-term projections. Although institutional participation is still small in relation to the total supply of SOL, the movements of these firms point to an expanding trend.

Impact on shares

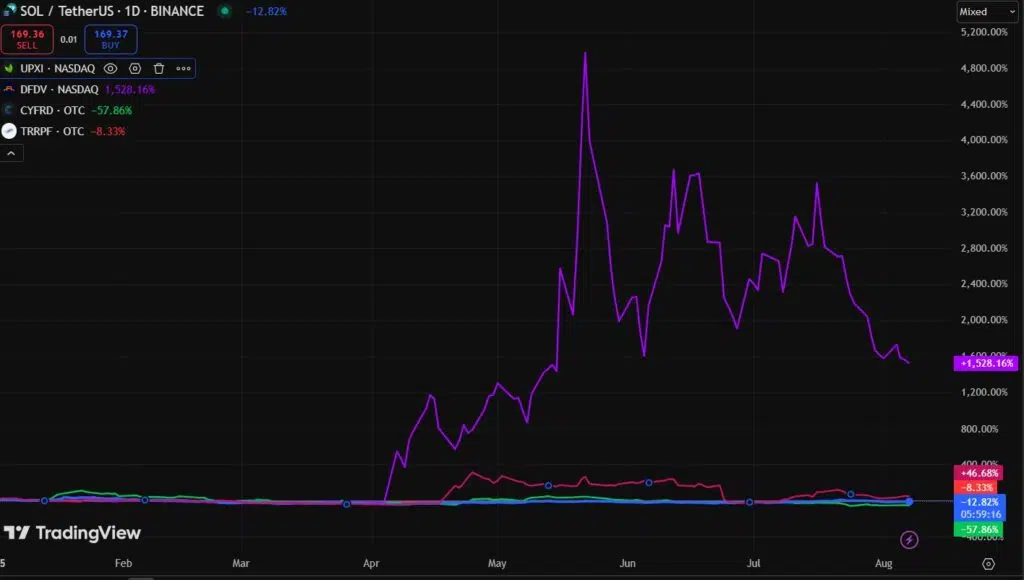

Shares of companies that have entered SOL have had variable performances.

For example, DeFi Developments Corp has benefited the most from the treasury strategy with SOL, accumulating yields of 1.400% so far in 2025.

Upexi, for its part, has also seen gains from its stake in SOL, with more moderate increases, of 44.5 per cent in its shares since January.

In the case of the other companies, their performances have not been so remarkable despite investing and exposing themselves to SOL. For example, Suns reports a 57.6 percent drop since Jan. The same is true of Torrent Capital, whose shares have fallen by 8.33% since the start of the year.

The following graph better appreciates these disparate movements:

Version of the example of Michael Saylor

This type of corporate exposure recalls the case of MicroStrategy (now Strategy), the firm led by Michael Saylor, which maintains more than 600,000 BTC in its treasure and is the largest institutional holder of bitcoin. Unlike that strategy centered on the world’s largest digital asset, these companies are betting on cryptocurrencies, with SOL, as the main alternative.

According to Prathik Desai, a financial analyst and digital asset strategist, the current rise of corporate cryptocurrency treasuries is entering a phase of natural selection, such as CryptoNoticias has reported. In this scenario, only assets with solid foundations and verifiable economic utility will be able to sustain their presence on institutional balances.

However, it should be borne in mind that most cryptocurrencies have historically depreciated against BTC. The question these entities now face is whether it makes sense to diversify beyond so-called digital gold.

In general, diversification into solana poses a commitment to technological utility. The Solana network is known for its speed of processing and low commissions. However, his record includes network interruptions and questions about his level of decentralization.

The key conclusion is to read what the institutional interest really means, Desai explains. Not always a backing to quality. Sometimes, it’s just a liquidity experiment, he adds.

The current environment seems to be a trial and error. The smaller utility cryptocurrencies could disappear after the next market correction. The time and financial statements will determine whether these bets are strategic decisions or passing trends.

It is clear that, for now, the impact of this trend is limited in terms of volume. However, its evolution could redefine treasury management in public companies, especially if investment in cryptoacs begins to correlate with key metrics of profitability or access to new markets. In that case, cryptoactive reserves would no longer be a financial curiosity to become a structural part of the balance sheet.