MYX Finance: An “MYX Token” rises 1,000% in a week

MYX, the native token of decentralized exchange (DEX) MYX Finance, surprises the cryptocurrency market after its price skyrocketed from $0.99 to $17.77 in just seven days, representing a rise of 1,695%

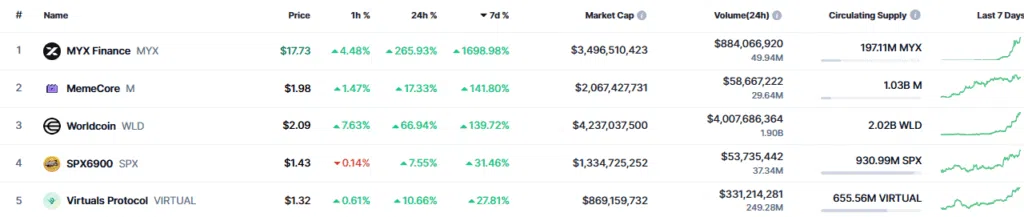

In this way, MYX is positioned as the cryptocurrency with the best weekly performance within the top 100 by market capitalization, as seen below:

MYX Finance is a DEX focused on derivatives trading, specifically perpetual contracts with leverage. The platform operates on BNB Smart Chain, the network created by the Binance exchange.

The project gained popularity after it won the Binance Annual Award on September 8, standing out as a leader in transaction volume. This is an event that aims to recognize and celebrate the most outstanding developers, innovators, and projects that contribute to the growth and development of the BNB Smart Chain network.

While the achievement gave impetus to the project, some specialists argue that the growth is not organic, but the result of possible pump-and-dump strategies.

As explained by CriptoNoticias, it is a market manipulation mechanism that occurs when a group of traders acquires large volumes of a cheap asset and, through rumors, news, false statements, or advertising, generates expectations to attract more buyers and cause a rapid price rise.

Once the price is skyrocketing and there is demand, traders who initiated the mechanism part ways with their holdings. That’s when the asset crashes, and there isn’t enough buying level to sustain, and most investors who came in late end up losing money.

In this regard, the financial markets analyst known as 0xD0M_ in X warns: “Some questionable activities were carried out today with MYX. Here’s a more detailed breakdown that shows why MYX appears manipulated.”

The first red flag the analyst finds is that the daily volume of perpetual futures contracts went from 6 billion to 9 billion, according to data from DeFiLlama. “This is somewhat unnatural compared to MYX’s small market cap and liquidity and is a classic sign of inflated numbers to attract retail traders,” he added.

It further notes: “Over $10 million worth of short positions liquidated in one day, and whales deliberately pushed the price up to cause liquidations. This creates artificial demand that disappears once the shorts leave or once they finish getting rid of the 1.5% supply program to unlock today.”

This means that the move was triggered by whales, which forced massive liquidations of short positions (bets on the price to fall), generating artificial demand that drove the price of MYX up quickly. Another warning sign of a pump and dump maneuver.