A bitcoin license from El Salvador is like graduating from Harvard

During his speech at the Blockchain Rio 2025, Juan Carlos Reyes, president of the National Commission on Digital Assets (CNAD) of El Salvador, made it clear that one of the reasons why El Salvador is a global reference in the regulation of cryptocurrencies is its rejection of speculative tokens and projects without support.

Getting a license in El Salvador is like graduating from Harvard: only the best ones achieve it, said Reyes, who also highlighted that Tether, a key player in the stablecoin market, is operating under El Salvador’s regulation, aligning himself with our vision. They understand that we focus on creating the best rules and best oversight for digital assets.

The regulatory specialist explained that his team’s focus combines decades of experience in financial supervision with mandatory technical training in cryptocurrencies. He highlighted international cooperation as a pillar of his policy: Digital assets have no geographical barriers, and supervision should not have them either.

In this context, he recounted his recent tour of ten countries and announced that El Salvador has established agreements with entities such as the U.S. Securities and Exchange Commission (SEC) and the Brazilian Federal Police. Criminals believe they can transfer assets without detection, but each token with illegal activity is marked. We know where they are and who passes them.

Regulatory challenges in Latin America

While El Salvador sets strict standards, countries with larger ecosystems, such as Argentina and Brazil, face the challenge of integrating a greater diversity of actors without compromising law enforcement.

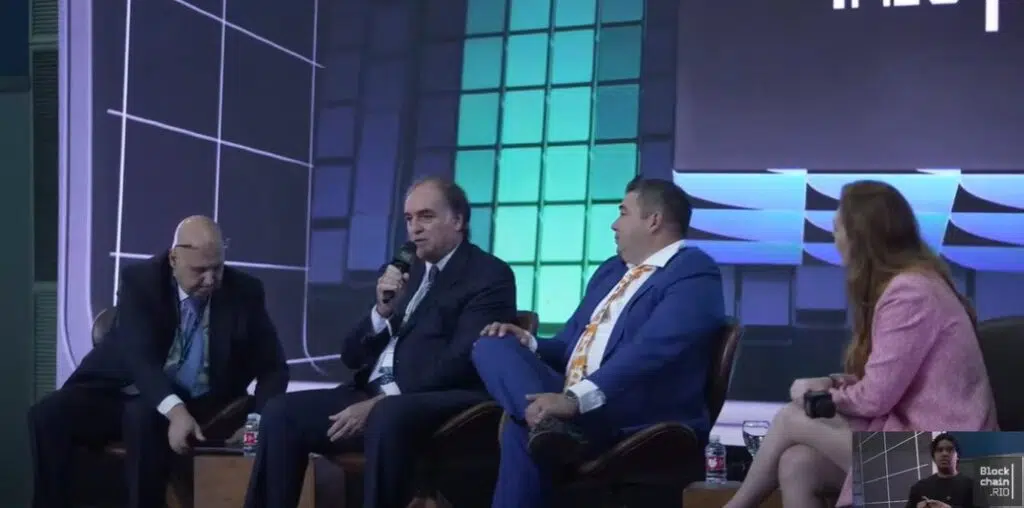

During the second day of the event, Roberto Silva, head of the National Securities Commission (CNV) of Argentina, shared a panel with Otto Lobo, president of the CVM of Brazil, and Juan Carlos Reyes himself. The focus was on the different regulatory strategies adopted by each country to accompany the evolution of the ecosystem in the region.

From Argentina’s perspective, Silva exposed the challenges faced by his management to implement a tokenization regime in a complex political context and how, despite the limitations, the country decided to move on.

“I don’t know if tokenization is the future, but if it is, very likely, we don’t want to be left behind,” said the specialist on the stage of the Blockchain Rio 2025.

Faced with the lack of legislative tools, since Javier Milei’s government does not have a majority in Congress, the CNV opted for a creative approach. I called my legal adviser and explained the restrictions we had. “We accepted them, but we decided to move forward the same,” Silva said.

As reported by CryptoNews, the agency launched a regulatory sandbox that sets precise conditions for the issuance and negotiation of digital values. Each instrument must be certified or in accounting format, and may only operate on authorised markets and through registered intermediaries.

This is not a process of discretionary selection, the head of the CNV emphasized, but of a one-year trial period. Silva said that, if the model works, new reforms could be introduced and even a law that formalizes the regime.

Constant dialogues to achieve a unified market

On the Brazilian side, Otto Lobo stressed the importance of developing regulations based on constant dialogue with the market. “In the CVM, our actions on digital assets are not based on a single specific event or mandate, but on a combination of internal and external factors that affect the integrity and evolution of the capital market,” he explained.

For Lobo, the key lies in maintaining a structured model that allows each regulatory initiative to be adjusted according to ecosystem feedback.

This is a collaborative task, like a puzzle where everyone brings their piece. “We listened to all the actors and we built together,” he summed up.

About this last point, Roberto Silva explained that Argentina adopted a gradual approach to the regulation of Virtual Asset Services Providers (PSAVs). First, an initial register was established to identify and order market players, both local and foreign. Then, progress was made with stricter regulations that are in the process of being implemented.

Thus, the head of the CNV stressed the importance of providing reasonable time for companies to adapt to the new requirements and acknowledged that, despite the difficulties, the process has shown significant progress in the formalization of the sector.

We made a two-step approach. First, in March last year, we established a register in which we had to register 165 people. This number consists of 12 individuals and 153 companies, of which 46 are foreign. This record covered both local and international businesses. Then we started working on regulation. We held a public consultation and ended the regulations in March of this year. The regulation will be fully in force by the end of 2025, but we gave companies a deadline to meet the registration requirements, which are stricter, during this year.

Roberto Silva, head of the National Securities Commission of Argentina.

Regarding the concrete progress of the process, Silva reported that the first deadline, which expired on 1 July, left only two registered individuals out of the initial 12. As for Argentine companies, of the 107 registered, more than 50 have already met the requirements, and the final figure will be known in the coming days.

Of the 46 foreign companies, 43 maintain an active record after the cancellation of three. In short, I think we will have between 80 and 90 registered companies, which is a significant number, the specialist concluded, highlighting the progress towards greater formalization and regulation of the Argentine digital asset market.

Otto Lobo explained that Brazil’s CVM took a functional approach rather than creating a specific regime for digital assets. As he detailed, if an instrument meets the legal characteristics of a value, then it falls under the jurisdiction of the CVM, regardless of the technology that supports it.

Collaboration with the Central Bank of Brazil, the IRS, and COAF is fundamental, especially in the fight against corruption and organized crime. Our priority is a risk-based approach, considering the size of investors,” he concluded.

The table made it clear that, while the roads are diverse, Latin America is moving towards a future where cryptocurrencies will no longer be a promise, but an integrated, robust, and regulated financial infrastructure.