Binance expects “deep impacts” for the regulation of cryptocurrencies

The first half of 2025 marked a turning point in the global regulation of cryptocurrencies, according to a report published by Binance Research. He argues that major economies have gone from ambiguous approaches to implementing clearer policies, shaping a policy landscape that is redefining capital flow, asset yields, and industry structure.

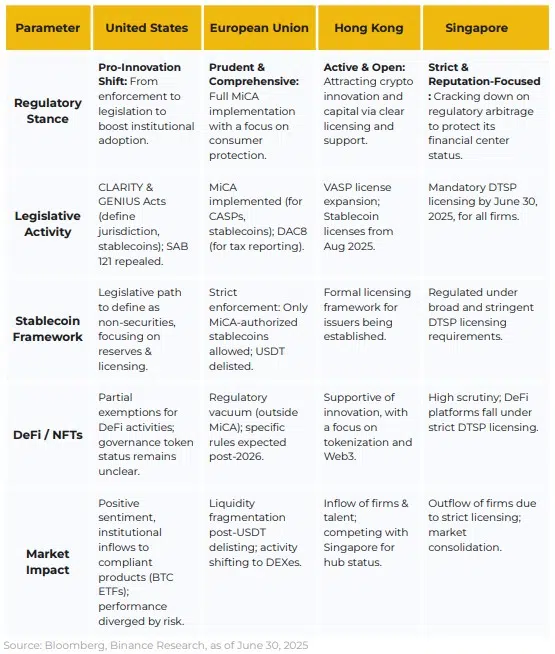

In this way, the report analyses several key aspects, focusing on how regulations vary significantly between regions such as the United States, the European Union, Hong Kong, and Singapore, and the deep impacts they are having on the market, from institutional adoption to new dynamics around stablecoins and decentralized finance (DeFi).

In the United States, analysts stress that the change of administration has led to a 180-degree shift in the regulatory approach, moving from a strategy focused on legal action to a clearer and more innovation-friendly legislative framework.

They also mention the appointment of Paul S. Atkins as chairman of the Securities and Exchange Commission (SEC), and the legal cases the agency has decided not to continue against several cryptocurrency companies.

For their part, two regulatory initiatives stand out in the corresponding section of the study: CLARITY (Digital Asset Market Clarity Act) and GENIUS (Guiding and National Innovation for U.S. Creation for U.S. Stablecoins).

The first addresses the conflict of jurisdiction between the SEC and the Raw Materials Futures Trading Commission (CFTC), establishing that digital “commodities” will be regulated by the CFTC, while assets linked to investment contracts will fall under the supervision of the SEC, depending on the degree of decentralization of the cryptocurrency network.

It is worth noting that CLARITY, while passed by the U.S. House of Representatives, with a bipartisan vote of 294 to 134, has not yet received the green light from the Senate, which is necessary for it to become law.

Meanwhile, as CryptoNews reported, the GENIUS law was ratified in both chambers and already signed by President Donald Trump. It establishes a federal framework for stablecoins, requiring them to be backed 1:1 with liquid assets and they have state or federal licenses, excluding them from the securities category.

According to Binance Research, these changes have had a positive impact on market sentiment, especially in bitcoin. Analysts point out that BTC’s cash-listed funds (ETF) have attracted significant institutional capital flows, consolidating their market dominance with a 65.1 per cent stake by June 2025.

However, the report points to a divergence in the return on assets: while bitcoin attracts investments due to its regulatory clarity, DeFi and altcoin projects face uncertainty, as their transition to the SEC requires revisions of the SEC and undefined maturity tests. This has limited their access to institutional capital.

Beyond the United States

In the European Union, the document stresses that the full implementation of MiCA (Markets in Crypto-Assets) has established a comprehensive regulatory framework for cryptocurrency and stablecoin service providers, which has had a significant effect on the market, especially with the exclusion of tether (USDT) in the eurozone. Because of this, exchanges such as Coinbase, Kraken, and Binance have delisted USDT for European users or limited it to a way of selling only.

This would have benefited compliant stablecoins such as USDC and EURC, although researchers point out that the volume of euro-denominated stablecoin operations has not grown significantly, suggesting that the change responds more to regulatory compliance than to organic demand. In addition, they indicate that the lack of specific regulation for DeFi under MiCA generates a regulatory vacuum, with rules foreseen for after 2026, which generates uncertainty for this sector.

In Asia, Hong Kong and Singapore represent opposite approaches. Hong Kong takes an open stance, seeking to attract innovation and capital through licenses for stablecoin issuers and expanding the reach of Virtual Asset Services Providers (VASPs). In contrast, Singapore has tightened its regulations to avoid regulatory arbitrage and maintain its reputation as a low-risk financial hub.

As an example, they point out that the Monetary Authority of Singapore (MAS) demanded that all cryptocurrency companies obtain a license from the Tokens Digital Payment Services Provider (DTSP), which has led to an exodus of companies to jurisdictions such as Hong Kong and Dubai. The study, therefore, concludes that these policies have reduced Singapore’s competitiveness within the industry.

What to expect for the second half of the year?

Binance anticipates regulatory clarity in the U.S. The U.S. will continue to shape the market. Projects such as the GENIUS, CLARITY, the BITCOIN Act (which proposes a strategic bitcoin reserve), and the Anti-CBDC Surveillance State Act could consolidate a favorable framework for stablecoins, DeFi, Fi, and BTC, although altcoins will continue to face challenges until clearer policies emerge.

In addition, specialists predict that the macroeconomic environment in the United States will continue to favor a positive risk scenario, known in English as “risk-on rotation.” With inflation falling and a rapidly slowing labor market, they expect the Federal Reserve (Fed) to maintain a flexible stance, even considering possible rate cuts.

In parallel, they argue that the proposal of the “One Big Beautiful Bill” (A Big and Beautiful Bill), which could increase public debt by between 2 and 3 trillion dollars, points to a moderate fiscal stimulus, supporting consumer and business activity, and strengthening confidence in cryptocurrency markets during the second half of the year. However, they also warn of the consequences this could have in the long term.

The so-called “One Big Beautiful Bill” could increase the U.S. debt. US at between $2 and $3 trillion. While it is unlikely to significantly affect public spending for the rest of 2025, expectations of moderate fiscal stimulus beyond this year could boost market sentiment. In the short term, higher fiscal indebtedness could sustain consumer and business activity, although at the same time it raises long-term concerns about debt sustainability and upward pressure on long-term bond premiums.

Report by Binance Research.

Finally, there is a significant growth in the outflows of cryptocurrency firms and in strategic acquisitions by traditional financial institutions. From Binan, they conclude that institutional adoption will be consolidated, with asset managers such as BlackRock and Fidelity launching bitcoin and Ether (ETH) ETFs in cash, which already manage tens of billions of dollars.

However, it is also determined that market fragmentation and uncertainty in regions such as the European Union and Singapore could limit industry growth in some regions.