“Guessing the maximum price of bitcoin is useless”: Willy Woo

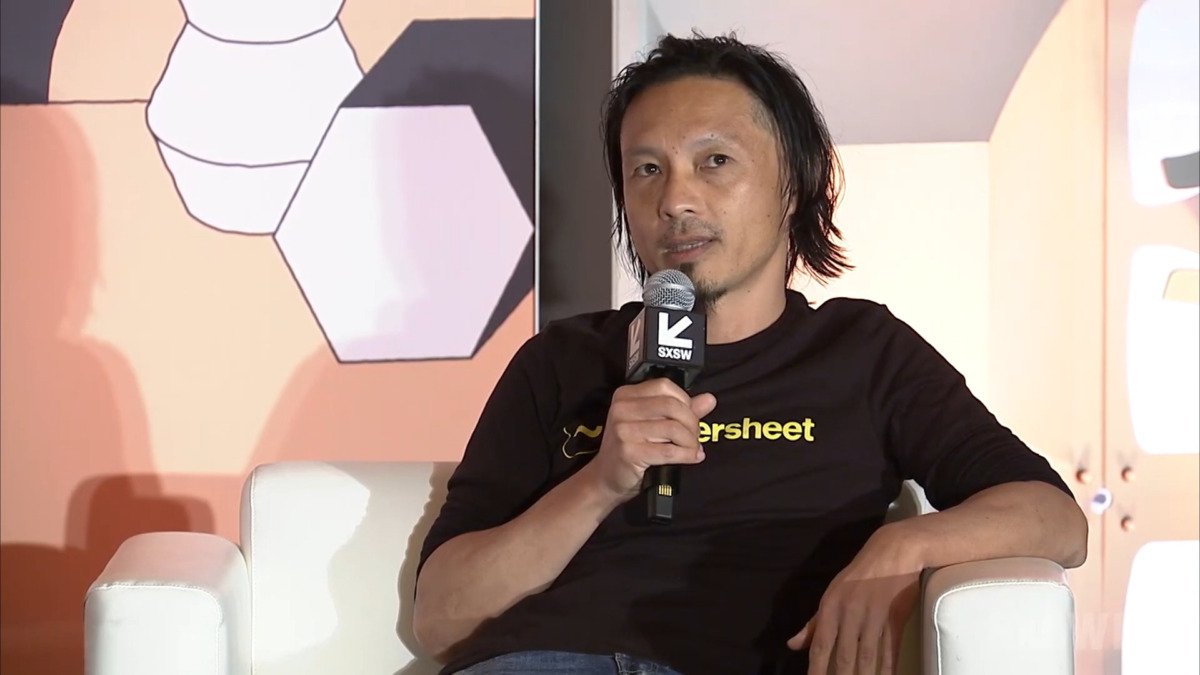

Willy Woo, analyst and professional trader, surprised everyone with a change of approach compared to previous cycles.

This time, the specialist did not venture to predict that the price of bitcoin (BTC) would reach $200,000 or $300,000, as it did in 2020 by the end of 2021.

Even now, 3 years later, bitcoin is close to $120,000, a far cry from those predictions, as can be seen in the price calculator.

Currently, Woo takes a more cautious stance, noting, “The main goal of the cycle? The important thing is the X-axis, while everyone is looking at the Y-axis.”

What Woo means is that most people only pay attention to how much the price rises (Y-axis), but he focuses on the X-axis (time), because he seeks to detect when liquidity starts to run out.

In response to the query of one of his followers, the specialist expanded his thesis and said: “The ceilings are unstable because the driving force, liquidity, disappears, and then volatility and irregularity increase because there is no liquidity buffer. Trying to guess a maximum price is a useless task, like thinking that noisy chaos should be orderly and predictable. The important thing is to identify when liquidity begins to disappear so that we can act as it approaches.”

This comment by Woo is important because it reinforces the central idea of his change: instead of trying to give exact figures, he focuses on metrics that show how the price of the asset evolves.

But why does liquidity work as a real cushion to the market? When it is high, it is because there are many active buyers and sellers, which allows you to execute trades without the price moving sharply, offering stability and favoring a more orderly advance.

On the other hand, when liquidity is low, there are few participants or little capital available, and even small movements can cause strong swings, increasing volatility and instability. Therefore, focusing on liquidity allows us to anticipate changes in trend before they are reflected in the price.

In the middle of the debate, one of her followers reminded her that she had shared a similar thought on other occasions. To which Woo replied, “I said a lot of things during my apprenticeship; some are correct, others incorrect. Most are determined randomly. The crazy thing is that people think I should be perfect, like it’s an oracle, and others think everything I say has to be wrong.”

In this way, he proposes to look beyond the price of the coin created by Satoshi Nakamoto and pay attention to other signs, which can offer a guide to make decisions responsibly and without getting carried away by emotions.