Monero suffers the largest accounting fraud

The Monero network recorded the largest reorganization in its recent history since the selfish mining attacks attributed to the Qubic mining pool began last July.

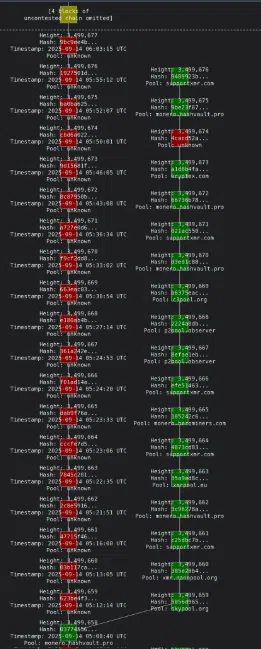

On Sept. 14, the Monero community echoed a new blockchain restructuring that affected a total of 18 blocks, between heights 3,499,659 and 3,499,676.

The reorganization invalidated 117 already confirmed transactions. This means that those operations, which were already listed as confirmed on the blockchain, were rendered ineffective after the reorganization of the blocks.

In practice, the payments returned to the state before confirmation and had to be forwarded to the network to be finalized, which reflects how an alteration of the accounting record impacts the validity of the transfers made.

This type of incident is not new for Monero, although this time it was the largest alteration of the accounting record since the sequence of attacks began.

Previous block reorganizations hurt the asset’s price. On this occasion, however, the value of the token maintained an upward trend even during the development of the affront against the network.

According to data from CoinMarketCap, XMR’s price went from $287 on Sept. 14 to $306 at the time of writing, representing an increase of close to 6% in less than 24 hours.