This is the hidden danger of US-held bitcoin

A recent report by the firm Unchained warns of the risks associated with bitcoin custody (BTC) in the United States. According to the analysis, although the uncertainty that custody of these funds is currently being maintained is small due to the Trump administration’s position, a change of government could make them a kind of easy way to obtain liquidity.

Analyst Nic Carter posted an excerpt from the report on his social media with a clear warning, arguing that the government’s efforts around bitcoin should not be celebrated, and that Donald Trump’s authorized strategic reserve remains a dangerous path.

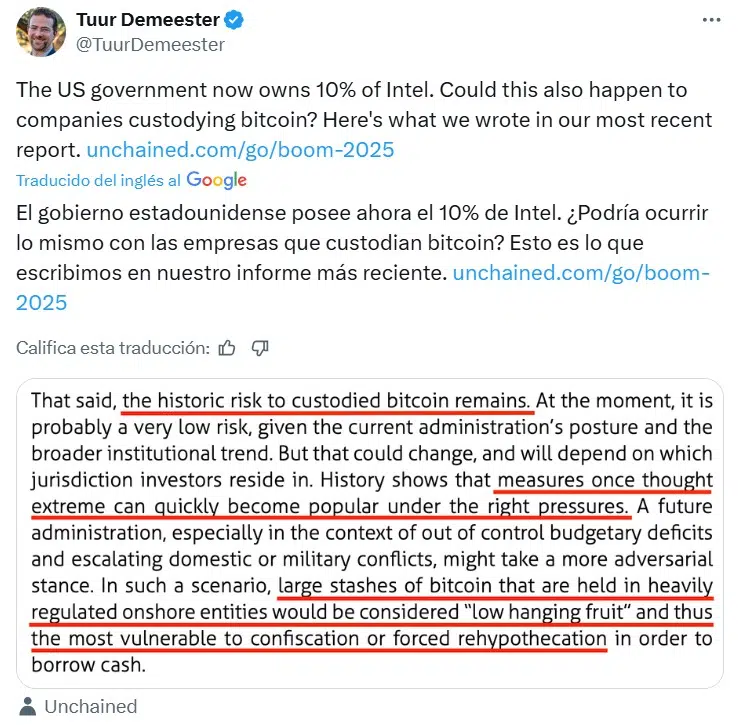

Thus, the report warns the following: History shows that measures that previously seemed extreme can become popular under certain pressures. In particular, he points out that a future government facing budget deficits out of control and escalating internal or military conflicts could take a more adverse stance.

In this regard, large bitcoin reserves held in heavily regulated local entities could be vulnerable to forced confiscations for liquidity.

Tuur Demeester, a finance specialist who shared the extract that Nic Carter retweeted, puts risk in perspective with a concrete example of other state investments. The U.S. government. The U.S. now owns 10 percent of Intel. Could something similar happen to companies that guard bitcoin?” he warned.

It should be remembered that, in March, President Donald Trump signed an executive order to create a bitcoin reserve, composed of assets seized by the government and without resorting to regular purchases of BTC. According to unofficial estimates, these are about 200,000 BTC, as reported by CryptoNotics.

The truth is that these warnings came from several months ago. In February, Arthur Hayes, former CEO of BitMEX, pointed out that the fundamental problem of a government accumulating an asset is that it buys and sells it mainly for political, not financial, reasons.

Therefore, the entrepreneur visualizes a scenario of maximum uncertainty if the opposition returns to power and finds millions of BTC ready to be sold.

Possible aftershocks at the state level

Although the United States is a federal country where each state has autonomy to legislate on its finances and digital assets, a national administration change could have repercussions on state governments if there are no laws to support them.

Remember that jurisdictions such as New Hampshire and Arizona have approved bitcoin reservations through legislation that empowers the creation of BTC reserves and cryptocurrencies, although with different approaches: New Hampshire authorizes direct investments, while Arizona allows the use of unclaimed digital assets and rewards for staking in a special fund.

However, if a federal administration hostile to the sector came to power, aligned state rulers and lawmakers could try to restrict or even confiscate these reserves to sell, replicating locally what is launched from Washington.

While Donald Trump’s return to the presidency has been accompanied by favorable rhetoric towards bitcoin and industry, and some measures have followed that line, it should not be lost sight of the fact that this is a political force.

Furthermore, the lack of clarity regarding the exact amount of BTC held by the government, the absence of transparent audits, and the back-and-forth in official rhetoric don’t help matters. First, the possibility of accumulating Bitcoin through neutral public spending strategies was raised, and then Treasury Secretary Scott Bessent assured that only seized assets would be retained. He ultimately qualified his words.

Faced with this lack of clarity, changes in position and differences in public policies around the digital currency, caution on this issue remains the best guide to analyzing government movements in the sector.