When will bitcoin get to the maximum of this cycle? Gold gives signals

Has bitcoin (BTC) arrived at the peak of the cycle, or is there even more rise? That’s the question many investors are asking themselves.

According to the analysis firm Weiss Crypto, gold is the key sign. This is so, as, in the past, the precious metal has proven to be an advanced indicator of the price of bitcoin for several months, especially at key market moments.

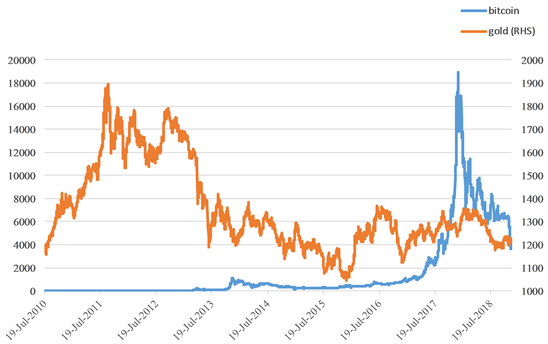

The company argues that, in analyzing the performance of both assets since 2018, it is evident that the important gold minimums usually precede those of bitcoin. In August 2018, for example, gold had a significant drop. Also, in December of that year, BTC hit bottom, as shown in the following graph:

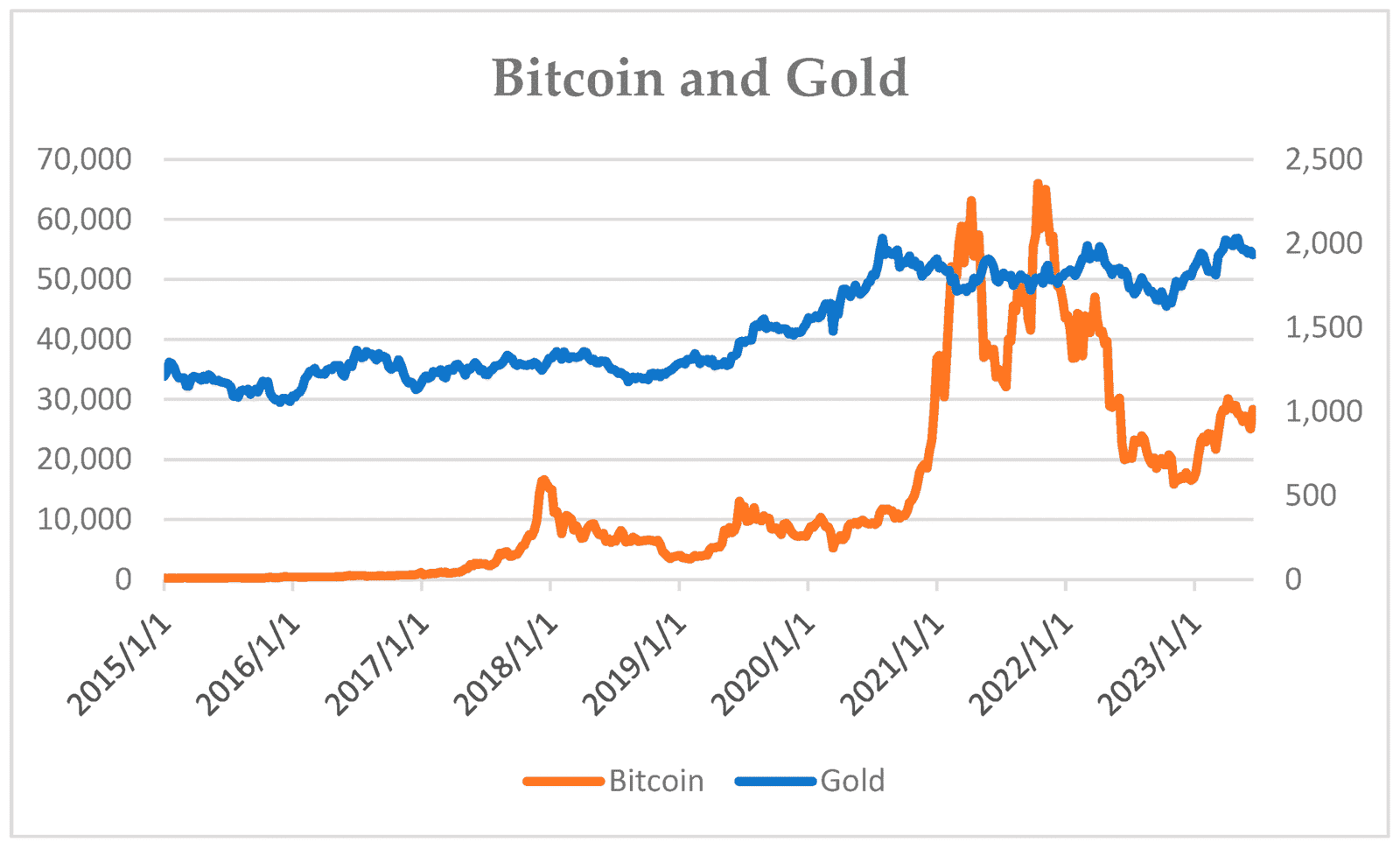

A similar situation occurred in the following cycle. By the time bitcoin peaked in November 2021, gold had already stopped setting new highs, which served as a warning of a correction. Here’s better:

In the current scenario, Weiss Crypto estimates that bitcoin could reach a new peak by the end of November 2025. This projection is based on its model that combines technical analysis and historical data. In his view, if the pattern is maintained, the current bullish cycle could have at least three months of growth.

However, the behaviour of gold in the coming months will be key. If the metal manages to exceed its April peak, close to $3,450 per ounce, this could point out that bitcoin has room to keep rising even until 2026. Instead, if gold begins to weaken, it could be an early sign that the bullish cycle is about to run out.

In addition, the current circumstances are not the same as those of previous cycles, as there have been wars and armed conflicts where the relationship between bitcoin and gold was temporarily reversed due to macroeconomic chaos, they say from the analytical firm.

So far this year, gold has appreciated by more than 25%. TradingView’s chart below shows that the price of gold remains on an upward trend and that the 14-day RSI is at 54.71, a neutral level, indicating that there is still room for further climbs without going into overbuy.

In addition, the RSI is upping its mobile average (yellow line), suggesting renewed momentum. If the price breaks the recent highs forcefully, it could continue its ascent. However, if the RSI falls back below its average, it could indicate a loss of strength.

Increased demand for hard assets

Weiss Crypto’s approach coincides with the analysis by investor Charles Edwards, founder of Capriole Investments, who highlights factors that could be pushing bitcoin and gold upwards.

Among them, high inflation in recent years, the freezing of foreign reserves from countries such as Russia, and trade conflicts between global powers. These elements have driven increased demand for alternative and decentralized assets, such as bitcoin.

Edwards suggests that, if the trend continues, bitcoin could reach $150,000 by the end of 2025, although the author warns that variables such as geopolitical tension could change that scenario.

In parallel, investment firm VanEck has also backed a bullish thesis for bitcoin. The company notes that the digital currency offers structural advantages over gold as a reserve of value. Among them, the fungibility of bitcoin, its transparency in transactions, and the programming of its scarcity, with a maximum emission ceiling of 21 million units, stand out.

VanEck presents figures that reinforce this vision. As of June 30, 2025, bitcoin shows a cumulative return of 35,000% in a decade. In shorter periods, profitability has also been significant: 122% in the last year, 99% in three years, and more than 1,200% in five.

According to the firm, while bitcoin volatility is high, a controlled allocation in traditional portfolios can improve risk-adjusted performance. In addition, it notes that in high inflation or monetary expansion environments, assets offer coverage that is not dependent on central authorities.

On the other hand, the geopolitical use of bitcoin has also gained ground. Since 2022, Russia has increased the use of cryptocurrencies in its foreign trade, as reported by CryptoNotics, in part in response to financial sanctions. This situation has reinforced the narrative of bitcoin as a tool to evade restrictions and preserve value in adverse contexts.

Analysts agree that golden behaviour should be closely watched for the remainder of the year. If the pattern of previous cycles is repeated, the movement of the metal in the coming months could anticipate not only the bitcoin roof, but also the start of a new winter.